Spring is here!

MORTGAGE UPDATE. NEW SPRING OPPORTUNITIES ARE UPON US! Despite what the markets are doing, there is nothing quite like the feeling of spring in the

MORTGAGE UPDATE. NEW SPRING OPPORTUNITIES ARE UPON US! Despite what the markets are doing, there is nothing quite like the feeling of spring in the

Are you looking to build or know someone looking to build in the Nelson area? This Sunday 7th May, between 1pm-3pm, Mike Greer Homes is

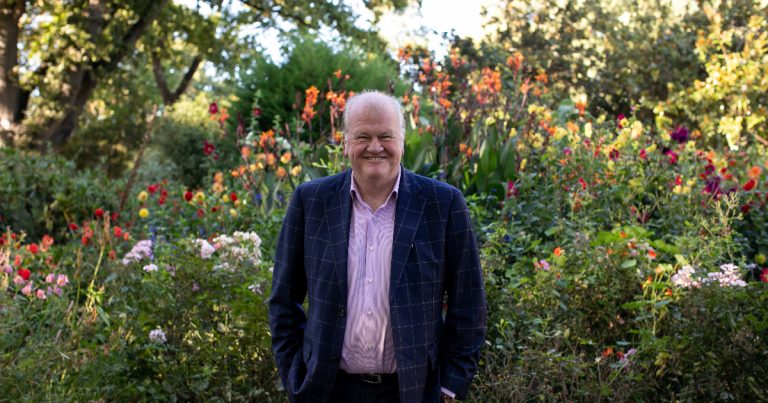

It is hard to believe I started in the mortgage business over 30 years ago. And now, we have reached a milestone of over $6,000,000,000

The new year has started and many commentators are trying their best to scare you with their own dire predictions for the rest of 2023.

The devastating events of this week have impacted so many New Zealanders and their families, their homes and workplaces. Many of our clients and their

As I often say “you don’t know what you don’t know”. If you are one of the 60% of Kiwi’s who have to reposition their

For our team 2022 felt like the fastest year yet. There was so much change in the market with many more challenges to come in

The past week has certainly not been the ‘Sunny Nelson’ we are all accustomed to and not only has the weather tested our wet weather

On 7 July 2022 some proposed changes to the Credit Contract and Consumer Finance Act (CCCFA) came into effect around current and future spending. Prior

Most people refinance or reposition their mortgage at the time their fixed-term comes to an end – which can make good sense, but that may

Around two-thirds of fixed rate loans are due to be rolled over this year. If yours are part of that group then you need to

We are incredibly proud to share that 2 of our advisers have been awarded a place in the NZA Elite Women 2022! Karyn and Chrissy

Tony Mounce Mortgages

1 Rimu Street, Riccarton, Christchurch

PO Box 29521,

Christchurch 8440

P +64 3 365 8625

F +64 3 365 8624