Finance Solutions

Refixing your home loan

More about buying a home:

If you’re approaching the end of your fixed-term mortgage period, it’s time to start thinking about talking to a mortgage adviser about refixing your interest rate or changing the way your mortgage is structured.

If they don’t hear from you, your lender may default your loan to their variable interest rate. Most lenders offer the best rates available on their digital platforms. Get in touch if you would like to discuss the best interest rate options to help you achieve your financial goals.

When should I refix my home loan?

Your lender should notify you a couple of months before your fixed–term period ends, but it pays to be proactive about these things so your mortgage adviser will be in touch with you ahead of time to discuss any changes to your circumstances and discuss your options. This will allow you and your adviser plenty of time to consider the lending products and rates available to you.

Your adviser will likely take stock of market trends and what has changed in the lending industry since your fixed-term agreement began. They’ll process this information and talk to you about any changes to your circumstances or your future goals and based on these — present you with the best options for your consideration.

What are my options when refixing my home loan?

- Lock in a new fixed rate – If you’re coming to the end of a fixed interest rate period and take comfort in knowing exactly what your repayments are going to be, you may want to lock in another term at a new fixed interest rate — with some luck this could be lower than your previous term

- Go for a floating (or variable) rate – You may now want more flexibility from your home loan and choose to switch to a floating rate. This may see your repayments go up or down as your lender’s interest rates rise or fall, but you’ll be able to make additional payments if you wish at no cost

- Choose a combination of fixed and floating rates – If you want to take advantage of a bit of both of the above, you can change to a combination of fixed and floating rates, putting a fixed-term rate in place for part of your home loan, and a floating interest rate in place for the remaining portion. You’ll be able to make extra payments while retaining some peace of mind around repayments

Take a more in-depth look at these options and additional ways you can restructure your mortgage.

It's a good time to review all your options when you are refixing your home loan.

If done correctly, the amount of research and negotiation involved in refixing your home loan is on par with what went into establishing your terms when you first purchased your home.

This is where our advisers are invaluable. We will always investigate what your current lender can offer you to retain your business, however we can also seek an alternative offer for you to consider. This ensures your current lender provides you with their best offer upfront. If for any reason you no longer wish to remain with your current lender, please let us know so we can seek several alternative options.

We can listen to your current needs and future goals and discuss your next step with you.

Where do you want to be?

We’re all about empowering our customers with the knowledge and assistance to get them where they want to be in life. Let TMO help pave the way to where you want to be.

Property Investor Success Stories

Claire and Hamish expand their portfolio

Location: Christchurch

Situation: Refinancing to expand investment property portfolio.

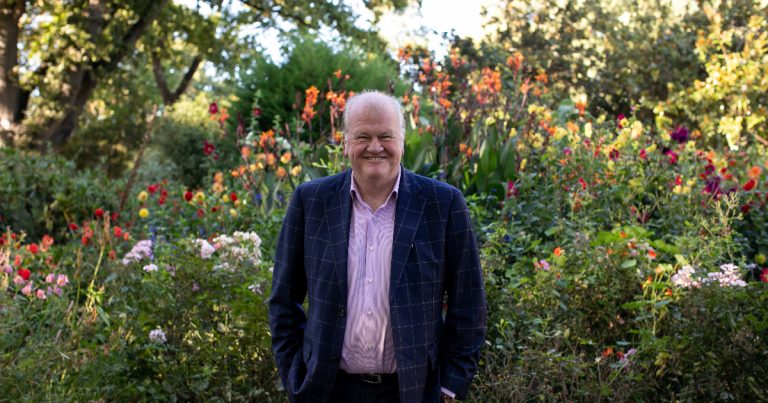

Adviser: Tony Mounce

TMO have been a huge part in the foundations of our investment strategy, and still are. As we’ve progressed and grown over the years, we have always valued their opinion and advice.

Without this we wouldn’t be living the life we are today, which is a direct result of the investment decisions we’ve made. We like the no-nonsense ‘just get on with it’ approach and TMO always seem to find a way to make it happen.

Plus, they are extremely responsive and available to help when needed.

Claire and Hamish

Property investors

Content about finance solutions

Read helpful blogs about various finance topics.

Spring is here!

MORTGAGE UPDATE. NEW SPRING OPPORTUNITIES ARE UPON US! Despite what the markets are doing, there is nothing quite like the feeling of spring in the

Is it time to refix?

Most people refinance or reposition their mortgage at the time their fixed-term comes to an end – which can make good sense, but that may

Interest rates are moving – apply the “sleep test”!

Around two-thirds of fixed rate loans are due to be rolled over this year. If yours are part of that group then you need to